Tools For Understanding Your Strategic Environment

Understanding your company's environment is crucial to formulate a well-thought-out strategy. In this article, we'll dive into two popular tools, namely Michael Porter's five forces framework and the PESTEL analysis, to guide us in doing so.

It's crucial to understand what happens around us. Furthermore, it's also crucial to differentiate between what matters and what doesn't. The following tools and frameworks provide helpful guidance in identifying, analyzing, and understanding what factors and trends shape our company's business today as well as in the prospected future. To me, they propose a clear path to shift our view from the intuitive internal- or narrow- to the more conscious broad- and external perspective of our business.

Contents

Five Forces Framework

Michael E. Porter's five forces framework is one of the most used strategy tools within the last 40 years. It was originally published in 1979 but still holds true today and can be used to analyze any industry's structural profitability.

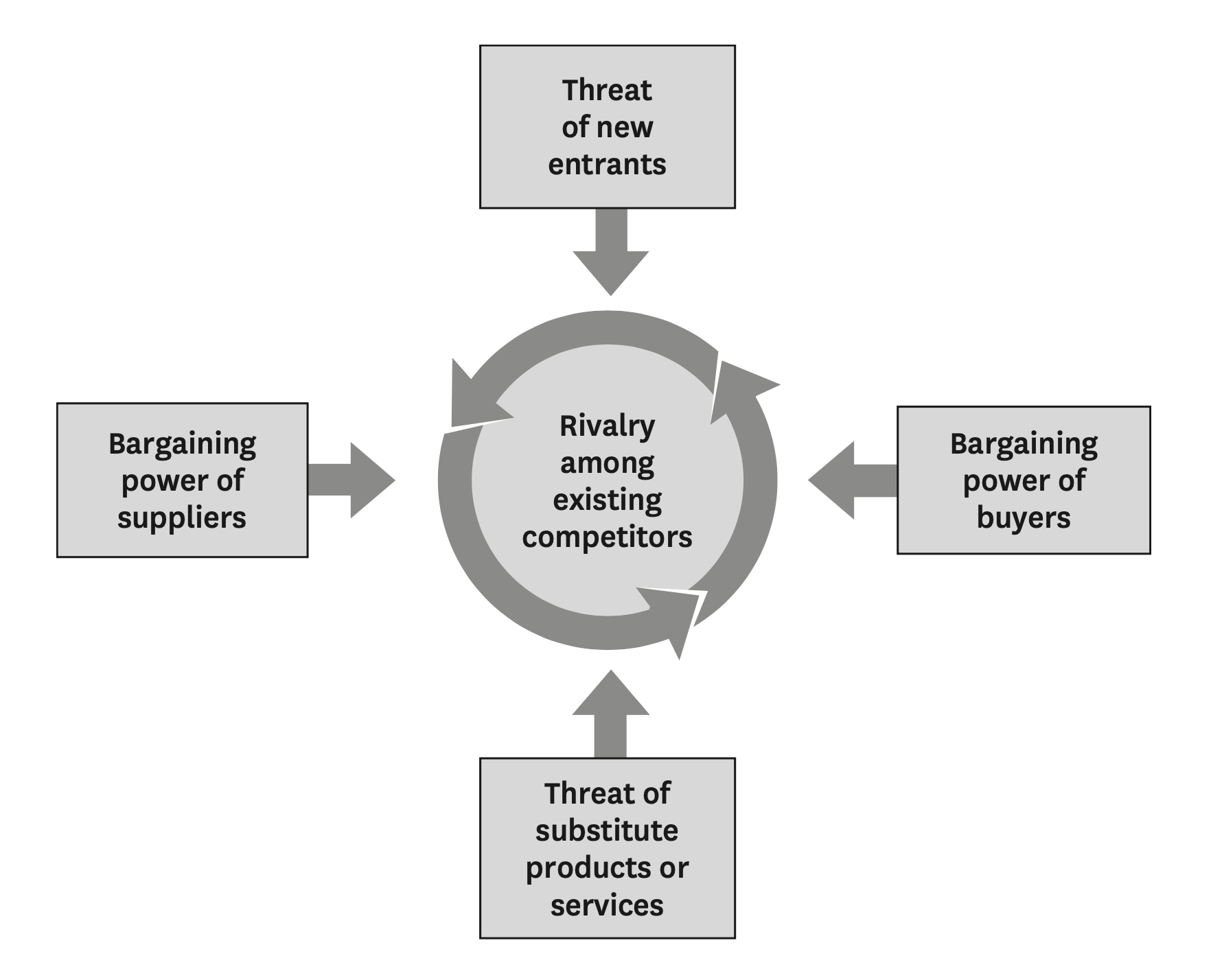

Creating and keeping a competitive advantage requires a unique position amongst competitors with activities that fit together and reinforce each other. You know that to sustain long-term profitability you must respond strategically to competition. And you naturally keep tabs on your established rivals. But as you scan the competitive arena, are you also looking beyond your direct competitors? As Porter explains, not just your direct competitors but also four additional competitive forces can hurt your prospective profits:

Savvy customers can force down prices by playing you and your rivals against one another, powerful suppliers may constrain your profits if they charge higher prices, aspiring entrants – armed with new capacity and hungry for market share – can ratchet up the investment required for you to stay in the game, and substitute offerings can lure customers away.

By analyzing all five competitive forces, you gain a complete picture of what’s influencing profitability in your industry. You identify game-changing trends early, so you can swiftly exploit them. And you spot ways to work around constraints on profitability – or even reshape the forces in your favor. By understanding how the five competitive forces influence profitability in your industry, you can develop a strategy for enhancing your company’s long-term profits.

The Five Forces Framework

The basic idea is that competition is often looked at too narrowly by managers by just focusing on the rivalry between existing competitors. Looking at all the five forces – where rivalry among existing competitors is just one – causes you to take a holistic look at any industry and understand the underlying structural drivers of competition and profitability.

That being said, no matter a company's relative position within an industry, the profitability – or the range thereof – greatly depends on the industry's underlying structure. In some industries, all five forces are very attractive (e.g. soft drinks) whereas other industries' forces hardly favor high profitability (e.g. airlines).

Let's take a detailed look at the five competitive forces:

Competitive Rivalry

Competitive rivalry is a measure of the extent of competition among existing firms. Price cuts, increased advertising expenditures, or investing in service/product enhancements and innovation are all examples of competitive moves that might limit profitability and lead to changes in the competitive landscape. Suppliers and buyers seek out a company's competition if they are able to offer a better product or lower prices. Conversely, when competitive rivalry is low, a company has greater power to charge higher prices and set the terms of deals to achieve higher sales and profits.

Threat of New Entrants

A company's power is also affected by the force of new entrants into its market. The less time and money it costs for a competitor to enter a company's market and be an effective competitor, the more an established company's position could be significantly weakened. An industry with strong barriers to entry is ideal for existing companies within that industry since the company would be able to charge higher prices and negotiate better terms.

Bargaining Power of Suppliers

If an industry is limited to a few crucial suppliers, they hold a large influence over the pricing of key inputs of a good or service. The dependency is affected by the number of suppliers, how unique these inputs are, and how much it would cost a company to switch to another supplier. The fewer suppliers to an industry, the more a company would depend on a supplier. As a result, the supplier has more power and can drive up input costs and push for other advantages in trade. On the other hand, when there are many suppliers or low switching costs between rival suppliers, a company can keep its input costs lower and enhance its profits.

Bargaining Power of Buyers

The ability of customers to drive prices intuitively affects profitability within an industry. It is affected by how many buyers or customers a company has, how significant each customer is, and how much it would cost a company to find new customers or markets for its output. A smaller and more powerful client base means that each customer has more power to negotiate for lower prices and better deals. A company that has many, smaller, independent customers will have an easier time charging higher prices to increase profitability.

Threat of Substitutes

Many existing products' or services' value propositions may also be delivered by substitute products. If the price of a given product rises (e.g. butter), a substitute that fulfills the same or a similar purpose (e.g. margarine) may become more attractive, causing consumers to switch over. Obviously, substitutes that can be used in place of a company's products or services pose a threat. Companies that produce products or services for which there are no close substitutes will have more power to increase prices and lock in favorable terms. When close substitutes are available, customers will have the option to forgo buying a company's product, and a company's power can be weakened.

Performing a Five Forces Analysis

Understanding the forces that shape industry competition is the starting point for developing strategy. The forces reveal the most significant aspects of the competitive environment. They also provide a baseline for sizing up a company’s strengths and weaknesses: Where does the company stand versus buyers, suppliers, entrants, rivals, and substitutes? Most importantly, an understanding of industry structure guides managers toward fruitful possibilities for strategic action.

Getting started with the five forces framework is best done by conducting an industry analysis and looking at the competitive landscape. You must understand what competitors exist, what products and services they are offering to whom at what price, in what geographic location, by what means etc. – hence, understand the competitors' business models thorougly. In addition to this mostly static snapshot, the framework also proposes to take a dynamic look: Asking questions about where and how the industry may change and what the implications of such changes are. Doing so will give a you good set of inputs to formulate a strategy.

PESTEL Analysis

The PESTEL analysis proposes a structure to allow macroeconomic developments and their impact on the company to be assessed. Doing so creates a basis of inputs for strategy development.

The PESTEL analysis helps you to analyze a company's external environment by looking at political, economical, social, technological, ecological, and legal factors influencing a company's business. It can provide an advance warning of potential threats and opportunities among these factors and helps organizations to understand external trends.

The PESTEL Factors

The PESTEL analysis relies in the identification and rating of influences that can then trigger further inputs on a company's strategy. This form of analysis is sometimes also referred to as STEEP analysis, STEP analysis, or PEST analysis. These follow the same form of analysis as PESTEL, except that some aspects (e.g. legal and ecological in the PEST analysis) are not taken into account. PESTEL forms the super-set of all these analysis frameworks, so let's take a look at the individual factors in more detail:

Political

Political factors determine the extent to which government and government policy may impact an organization or a specific industry. This would include political policy and stability as well as trade, fiscal, and taxation policies too.

Economic

An economic factor has a direct impact on the economy and its performance, which in turn directly impacts the organization and its profitability. Factors include interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates.

Social

The focus here is on the social environment and identifying emerging trends. This helps a marketer to further understand consumer needs and wants in a social setting. Factors include changing family demographics, education levels, income- and wealth distribution, cultural trends, attitude changes, and changes in lifestyles. Consider how trends towards healthier and more active lifestyles have ushered in the evolution of connected fitness technologies, as well as many changes to the nature of food products we consume and how these food products are packaged and marketed.

Technological

Technological factors consider the rate of technological innovation and development that could affect a market or industry. There is often a tendency to focus on developments only in digital technology, but consideration must also be given to new methods of distribution, manufacturing, and logistics. Possible mid- to long-term indicators to look at include changes in research and development spending of governments and companies, new patents, or even impactful announcements of disruptive products.

Ecological

Ecological factors are those that are influenced by the surrounding environment. With the rise in importance of CSR (Corporate Sustainability Responsibility) and sustainability, this element is becoming more central to how organizations need to conduct their business. Factors include climate friendliness, recycling procedures, reducing the carbon footprint, waste disposal, and overall sustainability.

Legal

An organization must understand what is legal and allowed within the territories they operate in. They also must be aware of any change in legislation and the impact this may have on business operations. Factors include employment legislation, consumer law, health and safety laws, andother regulations and restrictions. Political factors do cross over with legal factors; however, the key difference is that political factors are led by government policy, whereas legal factors must be complied with.

Performing a PESTEL Analysis

The desire for a PESTEL analysis may be triggered by an emerging internal move (e.g. venturing into a new country), a signal on a new trend (e.g. observing the increased home-delivery of goods), or just as a regular exercise (e.g. at the beginnign of the year). No matter the cause, there are several steps involved when undertaking a PESTEL analysis.

At first, it is important to brainstorm ideas across the different PESTEL categories. Formulate questions such as "what X factor may play a role for Y?" and collect what ever ideas come up. Weed through and sort these ideas by the expected impact they may have on your business. Only those influencing factors should be included that also have an impact on the company and its strategy, otherwise incorrect assumptions may be made that have a negative impact on the company's own strategy development, leading to wasted time and energy.

Next, you will want to consult and seek the opinions of experts outside of the initial brainstorming group. These could also be your customers, distributors, suppliers, or consultants who know your business well.

The third stage will involve you researching and gathering evidence for each insight in your analysis. Then you will want to evaluate and score each of the items for ‘likelihood’; how likely it is to happen and ‘impact’; how big an impact it could have on your business.

The final stage involves refining your ideas and repeating the proof until you have a manageable number of points in each of the six categories. Doing so will give a you good set of inputs to formulate a strategy and sustain your business in the long-term.

Thank you for reading this far! I hope this article is helpful to you as both of these proposed tools guide you to take a look outside – to focus on what may be coming but isn't part of the day-to-day focus yet. May it lead you to sustainable, profitable, and enjoyable strategy making!

– Dominik

Sources

:max_bytes(150000):strip_icc()/porter_final-b4b8e5b2014544dbaa1884017efbc164.png)